Risk Management In the Cryptocurrency Trade: Best Practices

The world of cryptocurrency trading has become more popular in recent years, and many people who have invested their money are earned in the heavily digital activity market. However, with great power, there is a high risk and operators must be aware of the potential pitfalls of the cryptocurrency trade to minimize and maximize merit.

In this article, we explore the importance of risk management in the cryptocurrency trade, discuss best practices in risk management, and provide suggestions on how to reduce general risks for cryptocurrency trade.

What is risk management in cryptocurrency trading?

Risk management of cryptocurrency trading refers to the process of identifying, evaluating and mitigating possible losses or disadvantages of trade. It means assessing the risks associated with every trade and implementing measures to minimize them. Effective risk management is essential for merchants to achieve their financial goals, including reaching Draw points, maximizing profits and protection from significant losses.

Because risk management is crucial in the cryptocurrency trade

The cryptocurrency trade can be very unstable due to market variation, prices vibration and liquidity problems. Without adequate risk management, operators may suffer significant losses that may be accompanied by economic spoilage. In addition, the encryption market is often subject to regulatory changes, technological interruptions and market manipulation, which makes it difficult for operators to provide market trends.

To navigate these risks, operators must develop effective risk management strategies that will help them protect their capital and achieve trading goals.

Best Practices in Risk Management In the Cryptocurrency Trade

Here are some of the best practices in risk management in the cryptocurrency trade:

- has set clear goals and risk tolerance

: Before commencing commerce, defining investment objectives and risks tolerance. Set up how much you can let you lose and what are your maximum possible.

- Use detention orders : Please implement your detention orders to limit your losses if the price drops below a certain level. This will help prevent significant losses in the case of market recession.

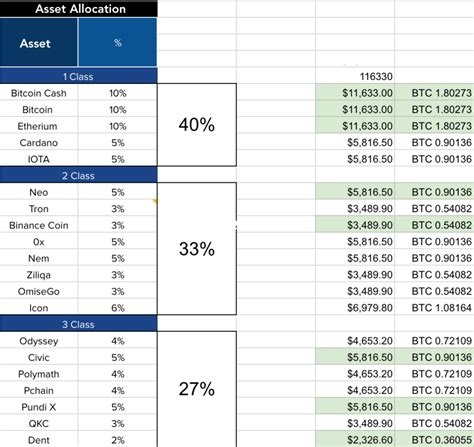

- Your versatile portfolio : Apply your investments to multiple cryptocurrencies, markets and functions to minimize exposure to a specific tool.

- Use the risk redemption ratio : Set the Risardo report for each shop, ensuring that any earnings exceed any losses.

5

- Keep sufficient capital : Make sure you have sufficient capital to cover the losses or variations on the market.

- Use technical and graphic indicators : Use technical and graphic indicators to analyze market trends and identify potential risks.

- Average Costs for one dollar : implement a dollar cost average to reduce the effect of market volatility in the investment portfolio.

Crypt Trading General Risks

Here are some common risks related to the cryptocurrency trade:

- Mercato Volatility : Cryptocurrency prices can flow quickly and unpredictably, leading to significant losses.

- Risks of liquidity : Liquidity problems can lead to negotiations or delayed execution through the resulting possibilities.

3

- Safety Risks : Negotiations on decentralized stock exchanges (DEX) and other encryption currency platforms include safety risks such as hacking and phishing attacks.

5

Mitage of general risks

To alleviate these general risks, operators should:

1.